Activities & Fun

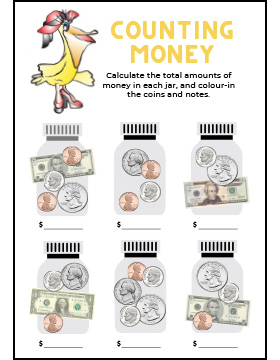

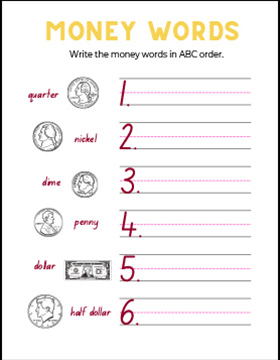

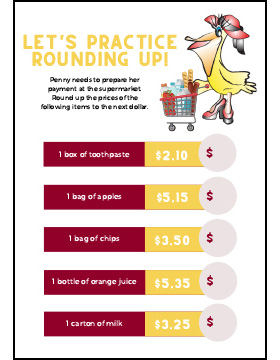

Worksheets

Coloring Sheets

Jokes & Riddles

Learn About Money

History

What is money? Money can be almost anything, as long as everyone agrees on its value. One of the earliest forms of money was metal, such as gold or silver. In North America, Native Americans used beads made of shell, called wampum, as a form of money.

Before people used money, they bartered, or traded, things they had for things they wanted. For example, a person may have traded three goats for two sheep. Each person had to give the other something they wanted and everyone had to agree that their value was similar.

People have used money for more than 4,000 years. It is believed the government of Turkey was the first to make coins which were a combination of silver and gold called electrum. Many ancient peoples including the Greeks and Romans used coins. The first types of paper money were used in China more than 1,000 years ago. Early paper money was a written note that a person could write which promised to pay a certain amount of gold or silver money later. Later, governments began printing paper money.

Today, paper money and coins that are used are called currency. Each country has its own form of currency. In the United States and several other countries, the currency is the dollar. Other common currencies are the euro, the peso, the pound, and the yen.

Fun Facts

Videos

How a Bank Works

Ways to Earn Money

How Coins Are Made

Credit: United States Mint

Field Trip to the Money Factory

Credit: USA.gov

US Currency Features

Credit: US Currency Educator Program

Journey of the US Currency

Credit: US Currency Educator Program

Privacy of Children

We recognize that protecting children's identities and privacy is important. We comply with the practices established under the Children's Online Privacy Protection Act (COPPA). We do not knowingly market to or solicit information from children under 13 years of age without parental consent.

COPPA was passed to give parents increased control over what information is collected from their children online and how such information is used. The law applies to websites and services directed to, and which knowingly collect information from, children under the age of 13. Synergy Bank’s website and online banking services are not directed to children under the age of 13, nor is information knowingly collected from them. For additional information on COPPA protections, visit the Federal Trade Commission's website at https://consumer.ftc.gov/articles/protecting-your-childs-privacy-online.